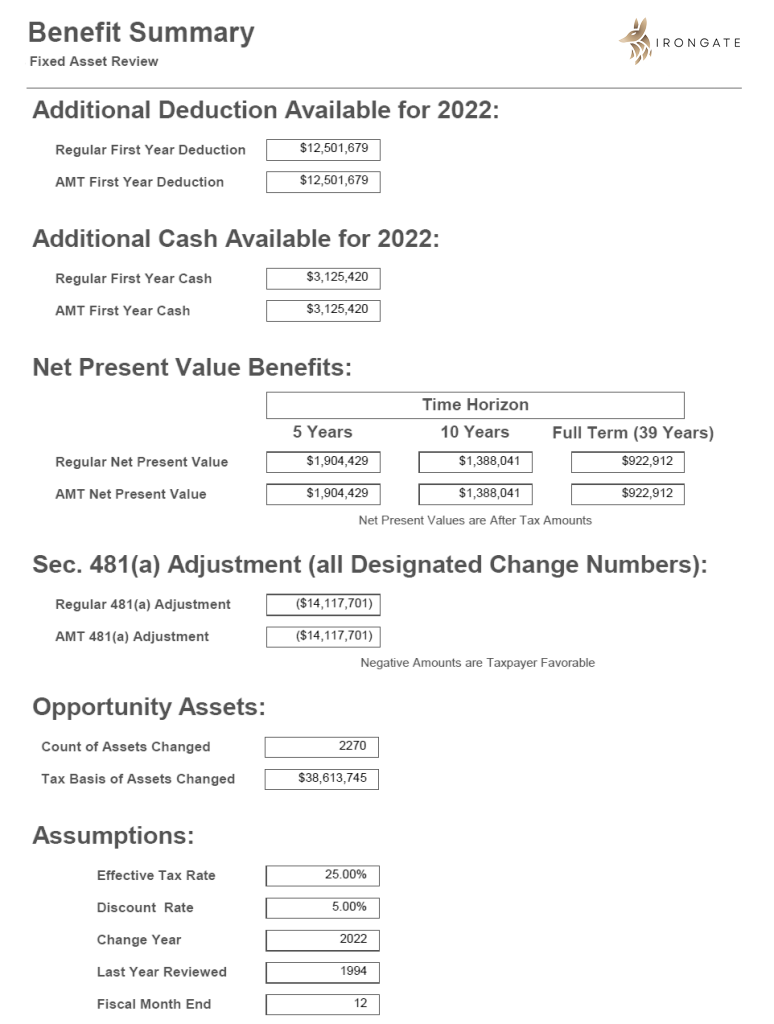

A Comprehensive Fixed Asset Review is a powerful tax planning strategy that evaluates a taxpayer’s entire depreciation schedule to find a multitude of opportunities to accelerate deductions and vastly improve cash flow.

Our Service

While this strategy includes reviewing assets for missed cost segregation studies, for taxpayers with numerous assets, this is a vastly superior planning idea since it reviews all assets for a multitude of opportunities, including:

Cost Segregation

Commercial buildings are depreciated slowly over 39 years. A cost segregation study carves out components from buildings that qualify for more rapid depreciation, such as land improvements and personal property.

Individual Asset Review

Individual assets are often inappropriately depreciated as part of a building, such as process-related plumbing, electrical, and ventilation systems. This study identifies assets qualifying for more rapid depreciation.

Capital to Expense Studies

The new TPRs allow taxpayers to retroactively review expenditures that were capitalized but qualify as repair and maintenance expenses, such as replacing roof membranes, resealing parking lots, and replacing of HVAC components.

Retirement Studies

Taxpayers often have ‘ghost assets’ in their fixed asset systems, such as removed roofs and HVAC components. A retirement study identifies these assets, allowing taxpayers to immediately deduct the remaining undepreciated basis.

Partial Dispositions

The TPRs now allow taxpayers who make improvements to their facilities to immediately deduct the cost of the removed building components and to instantly write-off undepreciated basis amounts.

Bonus Depreciation

Bonus depreciation allows taxpayers to immediately write off from 30% to 100% of the purchase price of a new asset, but is often missed. This study identifies missed bonus opportunities.

§45L Energy Efficient Home Credit

Allows eligible developers to claim a tax credit of $500 to $5,000 for each newly constructed or substantially reconstructed qualifying residence, which includes single family homes, apartments, condominiums, and student housing.

Demolition Costs

Demolition costs for building improvements are often capitalized with the cost of a new asset but can now be immediately deducted under the new TPRs

Intangible Asset Review

Taxpayers often have intangible assets on their fixed asset records that are amortized incorrectly or can be removed, such as an expired non-compete agreement. This study reviews intangibles for opportunities to accelerate amortization.

§179D Energy Efficient Commercial Building Deduction

Taxpayers who construct new buildings or make improvements to existing ones can take an immediate deduction of up to $5.65 per square foot for investments in efficient lighting systems, HVAC and hot water systems, and the building envelope.

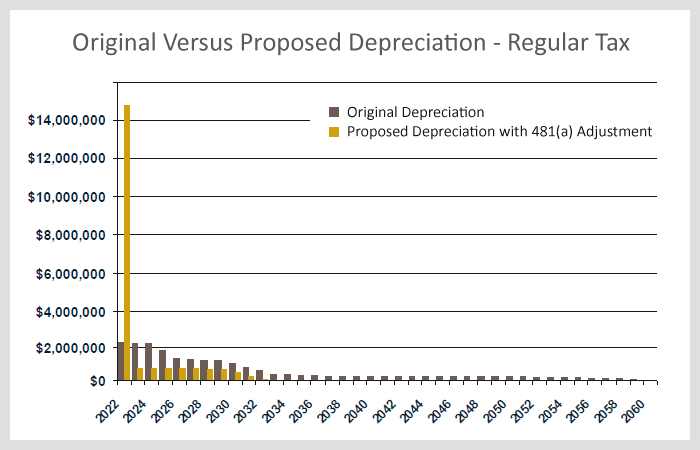

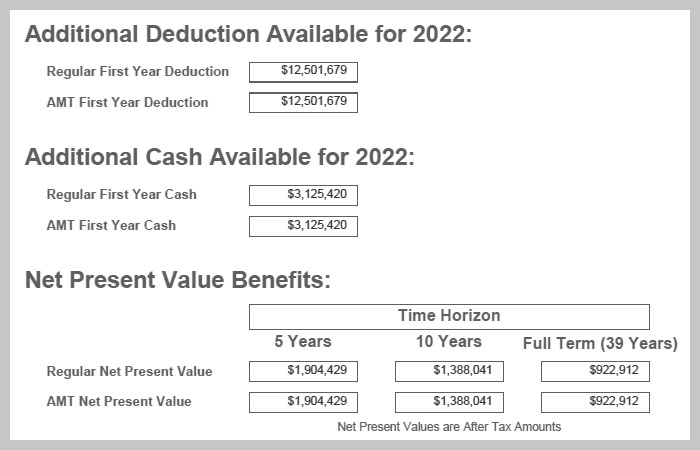

Our Technology

Our fixed asset analysis technology was designed in-house and is exclusive to IRONGATE. It has been used to complete hundreds of successful projects for manufacturers, financial institutions, telecommunication companies, retailers, property investors and numerous other taxpayers operating in a wide variety of industries. Sample reports from of our proprietary software:

Why Choose Us

Risk Free Calculations

We offer a free complimentary estimate.

We help your team execute

We’re here to help you reach your business objectives and achieve optimal outcomes.

We adapt to your needs

We’ll analyze your needs and create the best solution for your convenience.

What Our Lovely Clients Say

Here are the thoughts of our esteemed clients on their experience working with us.