The §45L Energy Efficient Home Credit, as established by the Energy Policy Act of 2005, allows eligible developers to claim a tax credit for each dwelling unit. Both single family homebuilders and multifamily developers can benefit from the §45L Credit. The Inflation Reduction Act of 2022 extended the §45L Credit for homes sold or leased during 2022 with little modification.

§45L CREDIT FOR 2022 AND PRIOR

For residences leased or sold prior 2022, single family homebuilders and multifamily developers can benefit from the §45L Credit. The maximum credits per dwelling unit are:

• $2,000 per unit for new energy-efficient home.

• $1,000 per unit for manufactured homes.

Requirements

An eligible contractor must have constructed a qualified energy efficient home, as well as owned and have had a basis in the home during its construction. Both new construction and renovations to existing residences are eligible when they meet the following qualifications:

The credit applies to single-family homes as well as apartment complexes, assisted living facilities, student housing and condominiums. Each unit in a multifamily residential facility may qualify.

Our Service

Our §45L Credit team includes HERS raters and tax professionals who will perform free assessments to prequalify your homes. Our study includes:

Reviewing construction documents

Interviewing design professionals, project managers, and other relevant personnel

Performing necessary testing and inspections

Modeling energy efficiency using IRS-approved software

Preparing certificates of compliance signed under penalties of perjury by a HERS rater

Coordinating with your tax preparer

Providing free audit support

Case Study

Each unit in a newly constructed apartment community qualified for the $2,000 per unit §45L Credit. With 220 units, the developer received a total tax credit of $440k.

Requirements

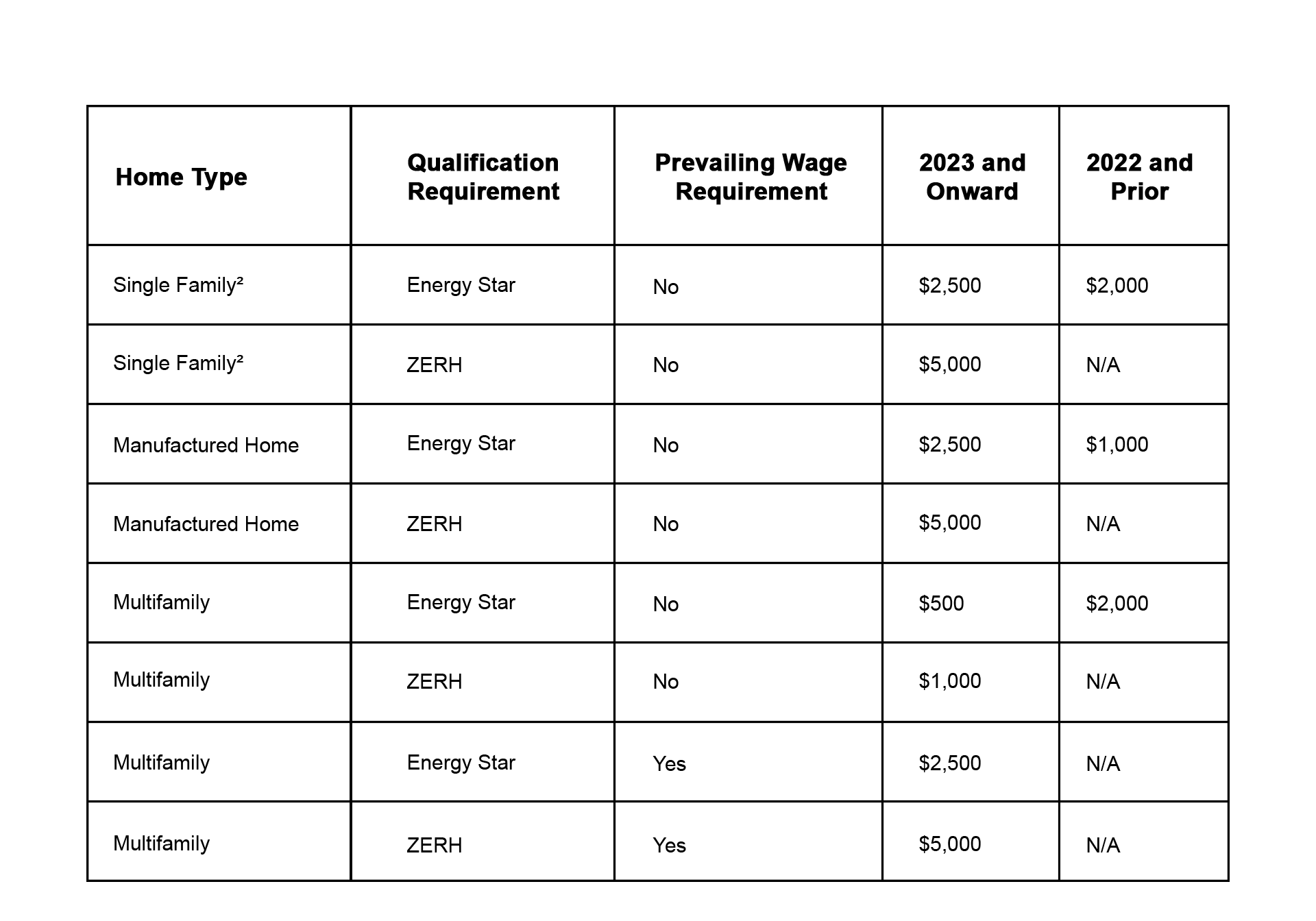

Single Family Homes Benefits and Requirements

• $2,500 tax credit for single family homes certified as ENERGY STAR Single Family New Homes Program Version 3.1. (For homes acquired1 before January 1, 2025 and Version 3.2 thereafter).

• $5,000 tax credit for single family homes certified as DOE Zero Energy Ready Home (ZERH).

Manufactured Homes Benefits and Requirements

• $2,500 tax credit for manufactured homes certified as ENERGY STAR Manufactured Home National Program requirements.

• $5,000 tax credit for manufactured homes certified as DOE Zero Energy Ready Home (ZERH).

Multifamily Homes Benefits and Requirements

• $500 tax credit for multifamily homes constructed after 2020 and certified as ENERGY STAR Single Family New Homes Program. When constructed with prevailing wage, the credit increases to $2,500.

• $1,000 tax credit for multifamily homes certified as DOE Zero Energy Ready Home. When constructed with prevailing wage, the credit increases to $5,000.

Buildings Higher Than Three Stories are Eligible

• Beginning 2023, all residential buildings are eligible. Homes leased or sold as a residence within buildings higher than three stories are eligible, including:

• Low-rise: 1-4 stories

• Mid-rise: 5-9 stories

• High-rise: 10 or more stories

§45L Credit Summary

1. Acquired by a person for use as a residence

2. Single Family includes site-built and modular single family homes, duplexes and townhomes

What Our Clients Say

Here are the thoughts of our esteemed clients on their experience working with us.